온라인바카라: 전략과 팁으로 승리의 길을 열다

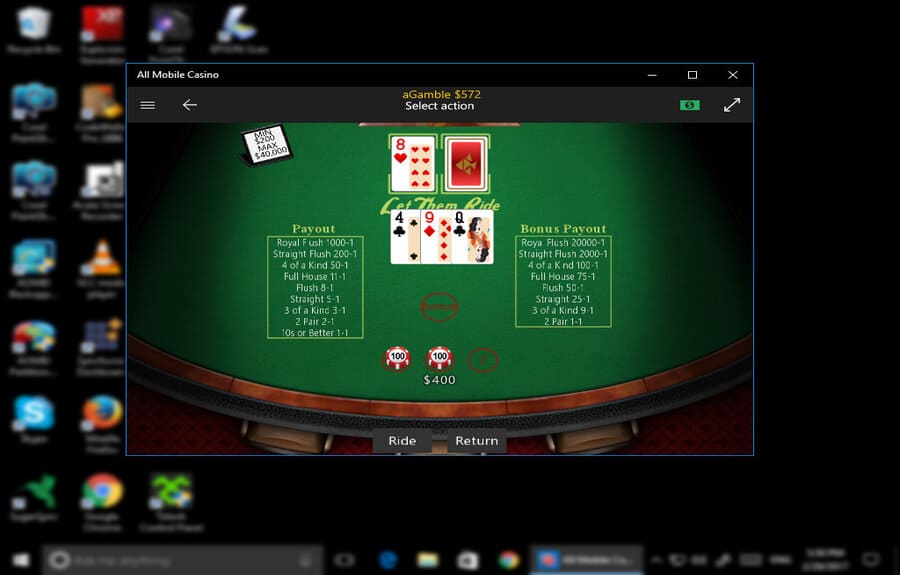

온라인바카라란 무엇인가? 온라인바카라는 현대적인 카지노 게임 중 하나로, 실제 카지노에서 즐기는 바카라와 동일한 규칙으로 이루어져 있습니다. 플레이어는 ‘플레이어’, ‘뱅커’, ‘타이’ 중 하나에 베팅을 하고, 가장 가까운 숫자에 9를 가진 쪽을 예측하는 게임입니다. 온라인바카라는 편리하게 인터넷을 통해 언제 어디서나 즐길 수 있는 장점이 있습니다. 승리를 위한 전략 온라인바카라에서 승리하기 위해서는 몇...